OK,还有没有更好玩的对

量化策略开发,高质量社群,交易思路分享等相关内容

『正文』

ˇ

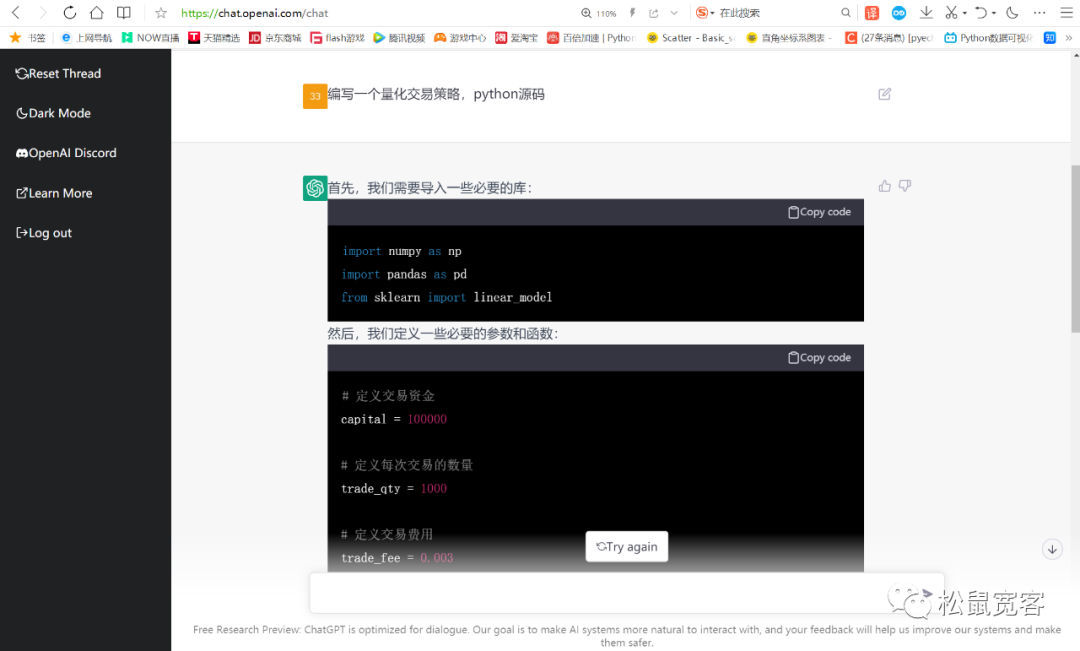

最近比较火的OpenAI-ChatGPT,太有意思了。尝试让它写了几个策略,您别说,还真是有模有样。我们来看看吧。

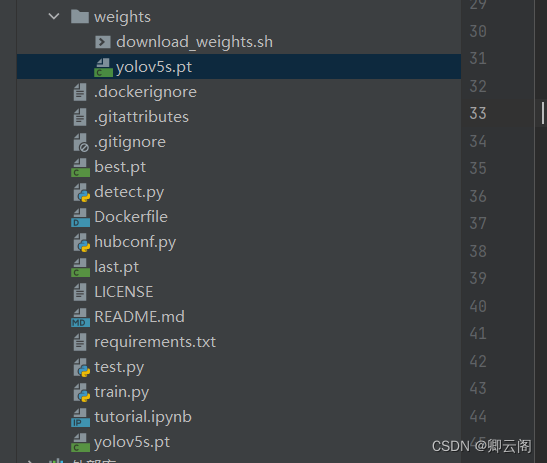

模型一:均值回归模型

源码:

import numpy as np

import pandas as pd

from sklearn import linear_model

import numpy as np

import pandas as pd

from sklearn import linear_model

# 定义交易资金

capital = 100000

# 定义每次交易的数量

trade_qty = 1000

# 定义交易费用

trade_fee = 0.003

# 定义时间跨度

time_span = 10

# 计算交易收益

def calc_profit(open_price, close_price):

return (close_price - open_price) * trade_qty - trade_qty * trade_fee * 2

# 计算交易均值回归模型

def calc_linear_model(df):

X = np.array(df['open']).reshape(-1, 1)

y = np.array(df['close']).reshape(-1, 1)

model = linear_model.LinearRegression()

model.fit(X, y)

return model.coef_[0][0], model.intercept_[0]

# 读入交易数据

df = pd.read_csv('trade_data.csv')

# 计算交易均值回归模型参数

slope, intercept = calc_linear_model(df)

# 初始化资产和交易结果

capital_list = []

result_list = []

# 开始交易

for i in range(time_span, len(df)):

# 计算收益

open_price = df.iloc[i-time_span]['open']

close_price = df.iloc[i]['close']

profit = calc_profit(open_price, close_price)

# 更新资产

capital += profit

# 记录交易结果

capital_list.append(capital)

result_list.append(profit)

# 输出交易结果

print('Final capital:', capital)

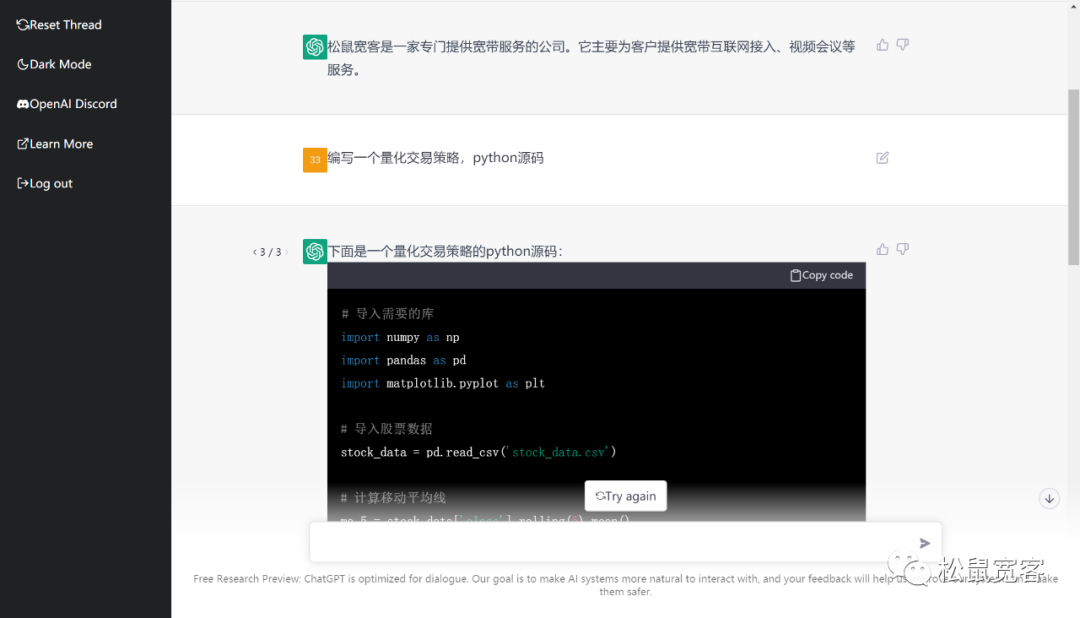

模型二:一个均线策略

源码:

# 导入需要的库

import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

# 导入股票数据

stock_data = pd.read_csv('stock_data.csv')

# 计算移动平均线

ma_5 = stock_data['close'].rolling(5).mean()

ma_10 = stock_data['close'].rolling(10).mean()

# 绘制移动平均线图

plt.plot(stock_data['date'], ma_5)

plt.plot(stock_data['date'], ma_10)

plt.title('Moving Average')

plt.xlabel('Date')

plt.ylabel('Price')

plt.legend(['MA5', 'MA10'])

# 定义交易策略

def trade(stock_data, ma_5, ma_10):

# 创建交易信号数组

signals = np.zeros(len(stock_data))

# 遍历每个交易日

for i in range(len(stock_data)):

# 如果MA5大于MA10,则买入

if ma_5[i] > ma_10[i]:

signals[i] = 1

# 如果MA5小于MA10,则卖出

elif ma_5[i] < ma_10[i]:

signals[i] = -1

return signals

# 运行交易策略

signals = trade(stock_data, ma_5, ma_10)

# 计算持仓和收益

position = 0

profit = 0

for i in range(len(signals)):

# 买入

if signals[i] == 1:

position += stock_data['close'][i]

# 卖出

elif signals[i] == -1:

profit += stock_data['close'][i] - position

position = 0

# 输出最终收益

print('Final profit:', profit)

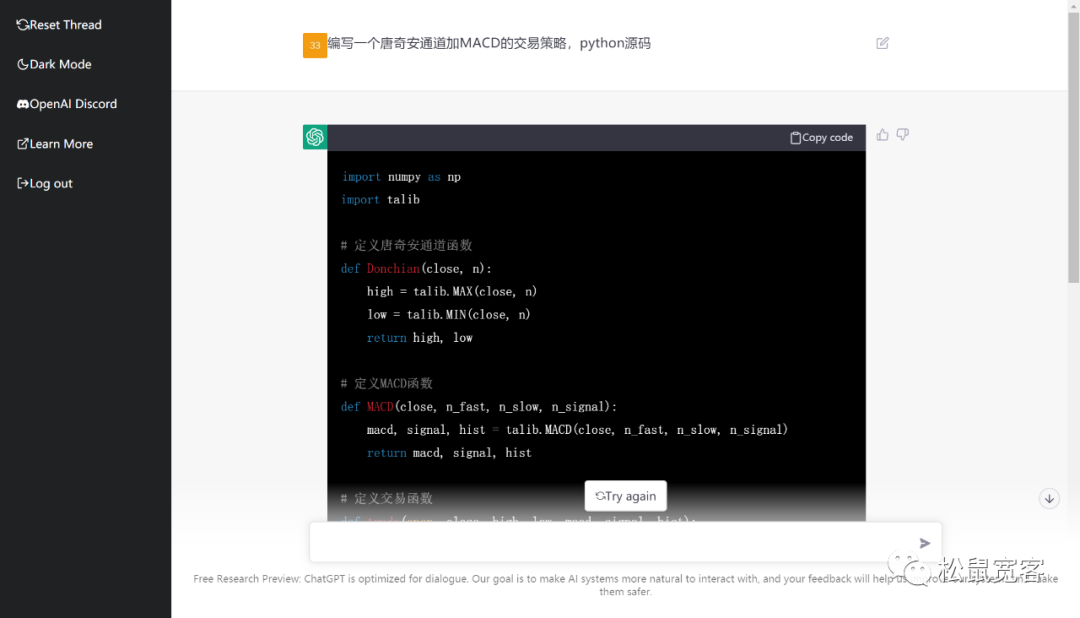

模型三:唐奇安通道+MACD

源码:

import numpy as np

import talib

# 定义唐奇安通道函数

def Donchian(close, n):

high = talib.MAX(close, n)

low = talib.MIN(close, n)

return high, low

# 定义MACD函数

def MACD(close, n_fast, n_slow, n_signal):

macd, signal, hist = talib.MACD(close, n_fast, n_slow, n_signal)

return macd, signal, hist

# 定义交易函数

def trade(open, close, high, low, macd, signal, hist):

# 初始化持仓状态和交易信号

position = 0

signal = 0

# 获取唐奇安通道上轨和下轨

donchian_high, donchian_low = Donchian(close, 20)

# 计算MACD和信号线

macd, signal, hist = MACD(close, 12, 26, 9)

# 判断交易信号

if position == 0:

# 如果当前没有持仓,判断开仓信号

if macd[-1] > signal[-1] and hist[-1] > 0 and close[-1] > donchian_high[-1]:

# 如果当前MACD大于信号线,且柱状图大于0,且收盘价高于唐奇安通道上轨,则开多仓

signal = 1

elif macd[-1] < signal[-1] and hist[-1] < 0 and close[-1] < donchian_low[-1]:

# 如果当前MACD小于信号线,且柱状图小于0,且收盘价低于唐奇安通道下轨,则开空仓

signal = -1

else:

# 如果当前有持仓,判断平仓信号

if position > 0 and close[-1] < donchian_low[-1]:

# 如果当前持多仓,且收盘价低于唐奇安通道下轨,则平多仓

模型四:机器学习策略

源码:

编写期货收益率预测模型的过程可能比较复杂,因为这类模型通常需要考虑许多因素。但是,以下是一个简单的Python程序,它使用Scikit-learn库来构建并训练一个期货收益率预测模型:

# Import necessary libraries

from sklearn import linear_model

from sklearn import metrics

# Load data

X = ... # Feature data

y = ... # Target data

# Split data into training and test sets

X_train, X_test, y_train, y_test = train_test_split(X, y, test_size=0.33, random_state=42)

# Train model

model = linear_model.LinearRegression()

model.fit(X_train, y_train)

# Evaluate model

y_pred = model.predict(X_test)

print(metrics.mean_squared_error(y_test, y_pred))

这个程序使用线性回归来构建模型,并用均方误差(MSE)来评估模型的性能。在实际应用中,您可能需要使用更复杂的模型,并使用多种指标来评估模型的性能。此外,您还需要准备足够的数据来训练模型,并确保数据的质量和准确性。

哈哈哈,太有意思了铁子们,我们和它聊聊天。

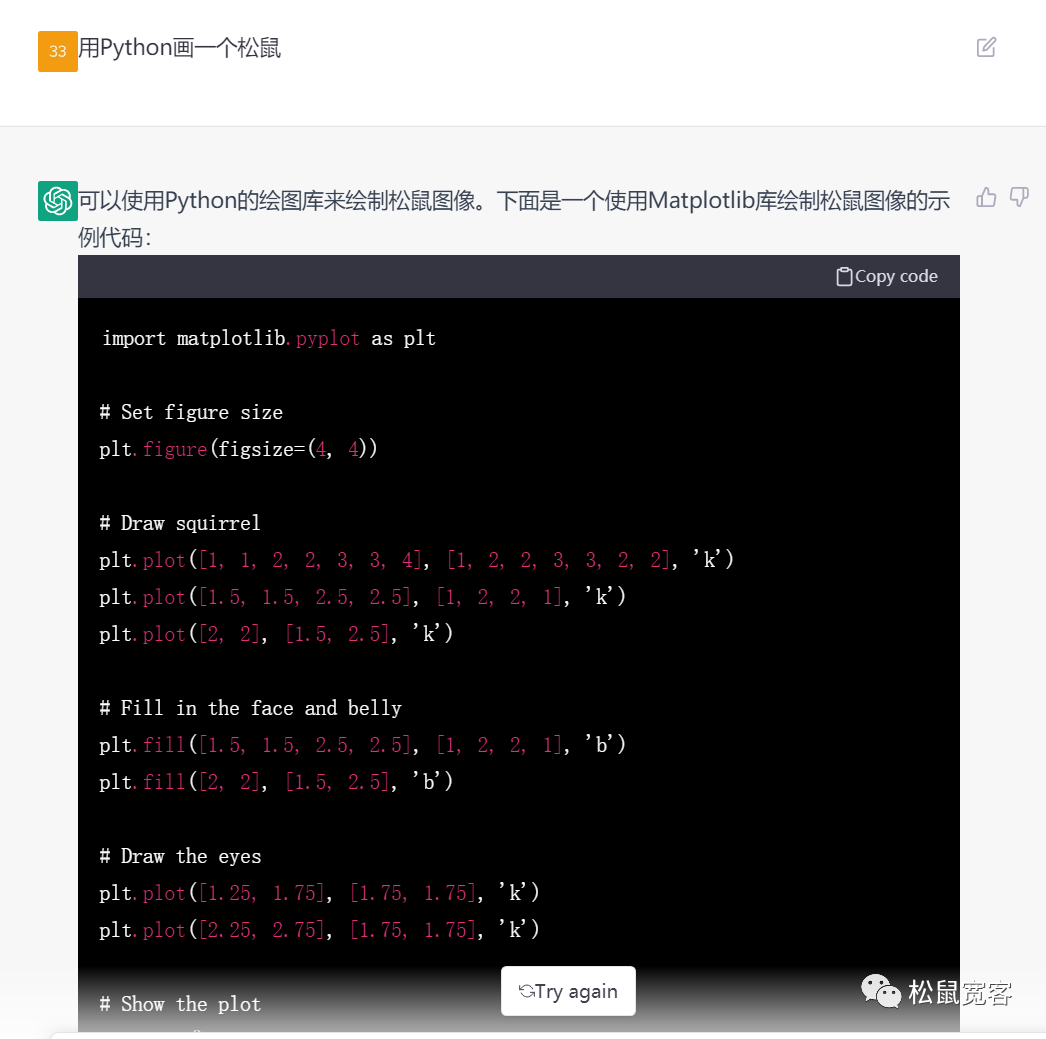

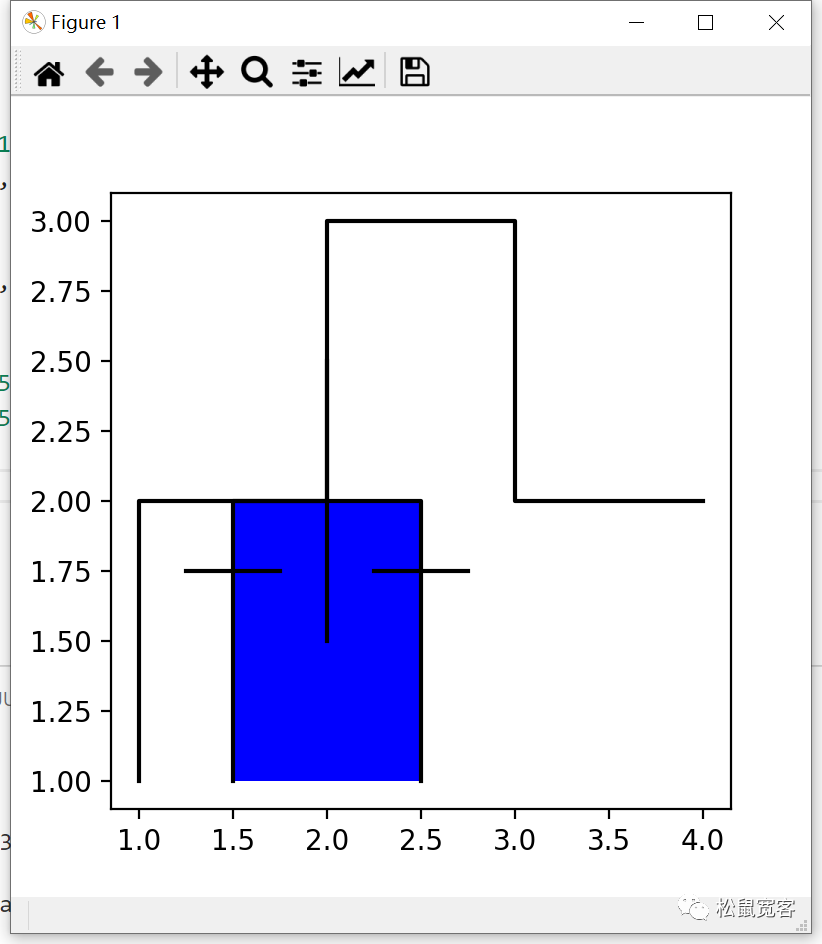

源码:

import matplotlib.pyplot as plt

# Set figure size

plt.figure(figsize=(4, 4))

# Draw squirrel

plt.plot([1, 1, 2, 2, 3, 3, 4], [1, 2, 2, 3, 3, 2, 2], 'k')

plt.plot([1.5, 1.5, 2.5, 2.5], [1, 2, 2, 1], 'k')

plt.plot([2, 2], [1.5, 2.5], 'k')

# Fill in the face and belly

plt.fill([1.5, 1.5, 2.5, 2.5], [1, 2, 2, 1], 'b')

plt.fill([2, 2], [1.5, 2.5], 'b')

# Draw the eyes

plt.plot([1.25, 1.75], [1.75, 1.75], 'k')

plt.plot([2.25, 2.75], [1.75, 1.75], 'k')

# Show the plot

plt.show()

哈哈哈哈,这也不像松鼠啊。

OK,还有没有更好玩的对话,评论区留言哈。

你要的干货都在这里→关注V V“松鼠宽客”

松鼠宽客:研究04丨波动率与CTA盈利关键![]() https://blog.csdn.net/m0_56236921/article/details/126655526?spm=1001.2014.3001.5502

https://blog.csdn.net/m0_56236921/article/details/126655526?spm=1001.2014.3001.5502

松鼠宽客:Pro08丨累计概率密度突破策略![]() https://blog.csdn.net/m0_56236921/article/details/126637398?spm=1001.2014.3001.5502松鼠宽客:KD01策略丨SuperTrend+空头波段

https://blog.csdn.net/m0_56236921/article/details/126637398?spm=1001.2014.3001.5502松鼠宽客:KD01策略丨SuperTrend+空头波段![]() https://blog.csdn.net/m0_56236921/article/details/126504676?spm=1001.2014.3001.5502

https://blog.csdn.net/m0_56236921/article/details/126504676?spm=1001.2014.3001.5502

松鼠宽客:加降息与BTC流动性事件策略研究![]() https://blog.csdn.net/m0_56236921/article/details/126136104?spm=1001.2014.3001.5502

https://blog.csdn.net/m0_56236921/article/details/126136104?spm=1001.2014.3001.5502

松鼠宽客:Pro_06丨重心拐点与高低波出场![]() https://blog.csdn.net/m0_56236921/article/details/126704447?spm=1001.2014.3001.5502

https://blog.csdn.net/m0_56236921/article/details/126704447?spm=1001.2014.3001.5502

松鼠宽客:基于订单流工具,我们能看到什么?![]() https://blog.csdn.net/m0_56236921/article/details/125478268?spm=1001.2014.3001.5502

https://blog.csdn.net/m0_56236921/article/details/125478268?spm=1001.2014.3001.5502

松鼠宽客:LM11丨重构K线构建择时交易策略![]() https://blog.csdn.net/m0_56236921/article/details/125632587?spm=1001.2014.3001.5502

https://blog.csdn.net/m0_56236921/article/details/125632587?spm=1001.2014.3001.5502