定义一个互换,本金为1e7,7年后到期

固定端:利率2.5%,每年付息一次

浮动端:Libor6M,每半年付息一次

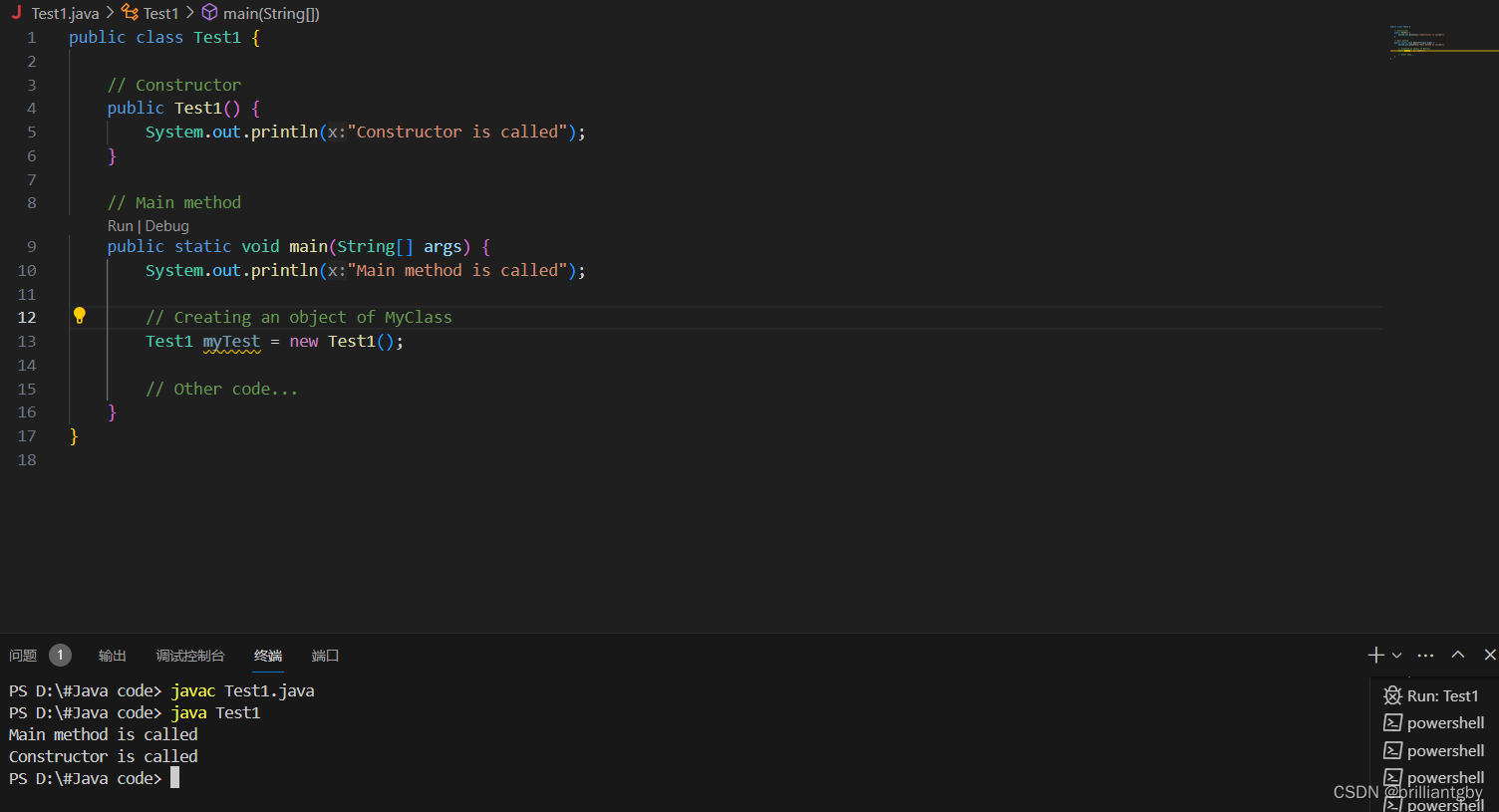

import QuantLib as ql

from prettytable import PrettyTable

# 定义全局时间:当前日期,下一个结算日,到期日

calendar = ql.UnitedStates(ql.UnitedStates.NYSE) # 定义整体日历格式

todaysDate = ql.Date(20, 10, 2015) # 定义估值日

settlementDate = calendar.advance(todaysDate, 5, ql.Days) #定义生效日

maturityDate = calendar.advance(settlementDate, 10, ql.Years) # 定义到期日

ql.Settings.instance().evaluationDate = todaysDate

# 定义利率的期限结构:

# 1.根据无风险利率确定利率期限结构,定义为:discount_curve

# 2.根据libor计算浮动利率端利率结构,定义为:libor_curve

risk_free_rate = 0.01

libor_rate = 0.02

day_count = ql.Actual365Fixed()

discount_curve = ql.YieldTermStructureHandle(ql.FlatForward(todaysDate, risk_free_rate, day_count))

libor_curve = ql.YieldTermStructureHandle(ql.FlatForward(todaysDate, libor_rate, day_count))

# 定义固定端基本参数

fixedLegFrequency = ql.Period(12, ql.Months)

fixedSchedule = ql.Schedule(settlementDate, maturityDate, fixedLegFrequency, calendar,

ql.ModifiedFollowing, ql.ModifiedFollowing, ql.DateGeneration.Forward, False)

# 定义浮动端基本参数

floatingLegFrequency = ql.Period(6, ql.Months)

floatSchedule = ql.Schedule(settlementDate, maturityDate, floatingLegFrequency, calendar,

ql.ModifiedFollowing, ql.ModifiedFollowing, ql.DateGeneration.Forward, False)

# 定义一个互换,本金为1e7,7年后到期

# 固定端:利率2.5%,每年付息一次

# 浮动端:Libor6M,每半年付息一次

swapType = ql.VanillaSwap.Payer

nominal = 10000000

fixedRate = 0.025

float_spread = 0.004

fixedLegDayCounter = ql.Actual360() # 固定端计息方式

floatingLegDayCounter = ql.Actual360() # 浮动端计息方式

libor3M_index = ql.USDLibor(ql.Period(6, ql.Months), libor_curve)

# 对swap进行估值

spot7YearSwap = ql.VanillaSwap(swapType, nominal, fixedSchedule, fixedRate, fixedLegDayCounter, floatSchedule,

libor3M_index, float_spread, floatingLegDayCounter)

swapEngine = ql.DiscountingSwapEngine(discount_curve) # 根据当前的利率结构折现求互换定价

spot7YearSwap.setPricingEngine(swapEngine)

# 打印固定端和浮动端的现金流

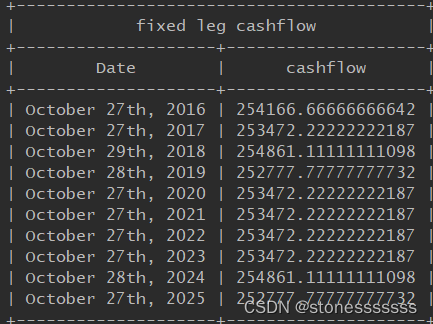

fixedTable = PrettyTable(['Date', 'cashflow'])

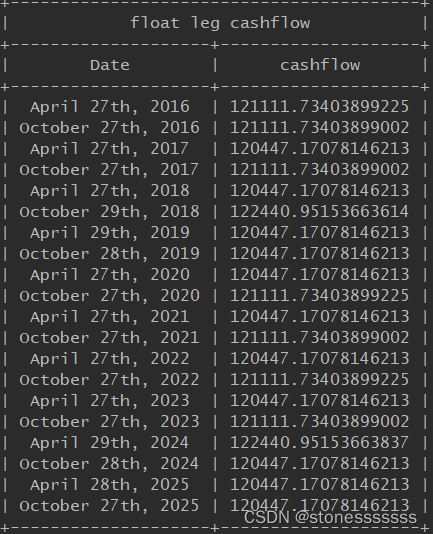

floatTable = PrettyTable(['Date', 'cashflow'])

for i, cf in enumerate(spot7YearSwap.leg(0)):

fixedTable.add_row([str(cf.date()), cf.amount()])

for i, cf in enumerate(spot7YearSwap.leg(1)):

floatTable.add_row([str(cf.date()), cf.amount()])

print(fixedTable.get_string(title="fixed leg cashflow"))

print(floatTable.get_string(title="float leg cashflow"))

# 打印swap整体情况

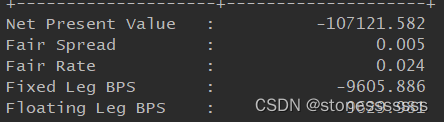

print("%-20s: %20.3f" % ("Net Present Value", spot7YearSwap.NPV()))

print("%-20s: %20.3f" % ("Fair Spread", spot7YearSwap.fairSpread()))

print("%-20s: %20.3f" % ("Fair Rate", spot7YearSwap.fairRate()))

print("%-20s: %20.3f" % ("Fixed Leg BPS", spot7YearSwap.fixedLegBPS()))

print("%-20s: %20.3f" % ("Floating Leg BPS", spot7YearSwap.floatingLegBPS()))

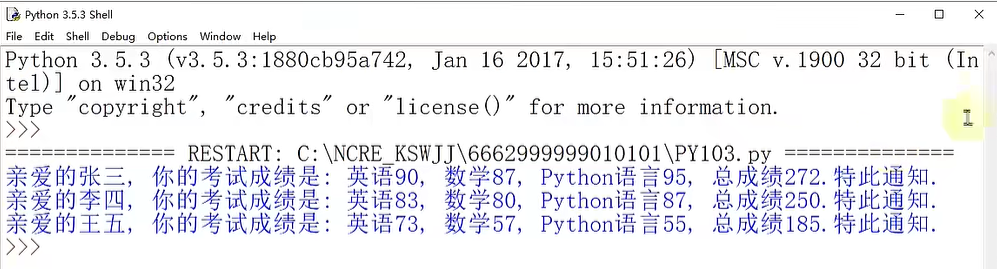

结果输出:

![[计算机网络]--I/O多路转接之poll和epoll](https://img-blog.csdnimg.cn/direct/af5a1f8d957f4f8da99d2015b10482bb.png)