Backtrader 文档学习- Observers

1.概述

在backtrader中运行的策略主要处理数据源和指标。

数据源被加载到Cerebro实例中,并最终成为策略的一部分(解析和提供实例的属性),而指标则由策略本身声明和管理。

到目前为止,所有backtrader示例图表都有三个默认绘制的东西,因为它们没有在任何地方声明,默认执行:

- 现金和价值(经纪人中的资金情况)

- 交易(也称为操作)

- 买入/卖出订单

它们是Observers观察者,存在于子模块backtrader.observers中。它们存在是因为Cerebro支持一个参数来自动添加(或不添加)它们到策略中: - stdstats(默认值:True)

如果默认值被使用,Cerebro将执行以下等效的用户代码:

import backtrader as bt

...

cerebro = bt.Cerebro() # default kwarg: stdstats=True

cerebro.addobserver(bt.observers.Broker)

cerebro.addobserver(bt.observers.Trades)

cerebro.addobserver(bt.observers.BuySell)

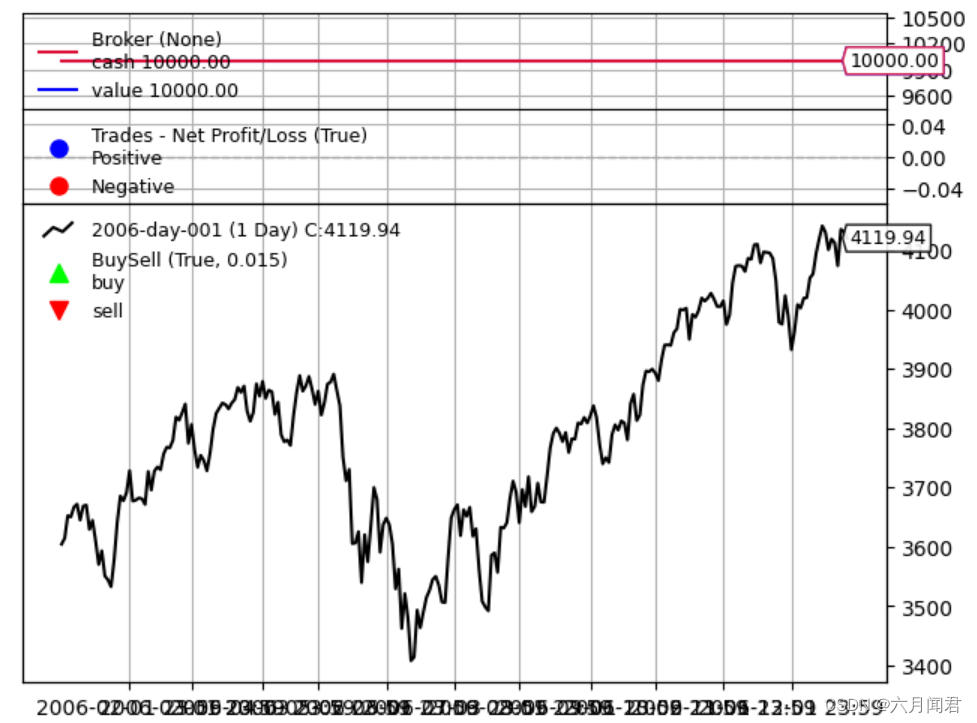

观察带有这三个默认观察者的常规图表(即使没有下达订单,没有交易发生,现金和组合价值也没有变化)

from __future__ import (absolute_import, division, print_function,

unicode_literals)

%matplotlib inline

import backtrader as bt

import backtrader.feeds as btfeeds

if __name__ == '__main__':

cerebro = bt.Cerebro() # stdstats=False

cerebro.addstrategy(bt.Strategy)

data = bt.feeds.BacktraderCSVData(dataname='./datas/2006-day-001.txt')

cerebro.adddata(data)

cerebro.run()

cerebro.plot(iplot=False)

图示:

在创建Cerebro实例时将stdstats的值更改为False(也可以在调用run时完成):

cerebro = bt.Cerebro(stdstats=False)

2.Accesing the Observers

观察者在默认情况下已经存在,并收集可用于统计目的的信息,这就是为什么可以通过策略的一个属性来访问观察者:

- stats

它只是一个占位符。如果回想一下如何添加默认的观察者:

...

cerebro.addobserver(backtrader.observers.Broker)

...

显然问题是如何访问Broker观察者。例如,如何从策略的next方法中执行此操作:

class MyStrategy(bt.Strategy):

def next(self):

if self.stats.broker.value[0] < 1000.0:

print('WHITE FLAG ... I LOST TOO MUCH')

elif self.stats.broker.value[0] > 10000000.0:

print('TIME FOR THE VIRGIN ISLANDS ....!!!')

Broker观察者就像数据、指标和策略本身一样,也是一个Lines对象。在这种情况下,Broker有2条线:

- cash

- value

3.Observer Implementation

实现与指标非常相似:

class Broker(Observer):

alias = ('CashValue',)

lines = ('cash', 'value')

plotinfo = dict(plot=True, subplot=True)

def next(self):

self.lines.cash[0] = self._owner.broker.getcash()

self.lines.value[0] = value = self._owner.broker.getvalue()

步骤:

- 从Observer(而不是Indicator)派生

- 根据需要声明行和参数(Broker有2行但没有参数)

- 将自动属性_owner,设置为持有观察者的策略

注意:_owner的属性

观察者开始工作:

- 在所有指标计算完成后

- 在策略next方法执行后

- 意味着:在循环结束时…观察到发生了什么

在Broker中,只是机械地记录在每个时间点上经纪人现金和组合价值。

4.Adding Observers to the Strategy

如上所指出的,Cerebro使用stdstats参数来决定是否添加3个默认的观察者,减轻了最终用户的工作。

添加其他观察者是可能的,无论是沿着stdstats还是删除它们。

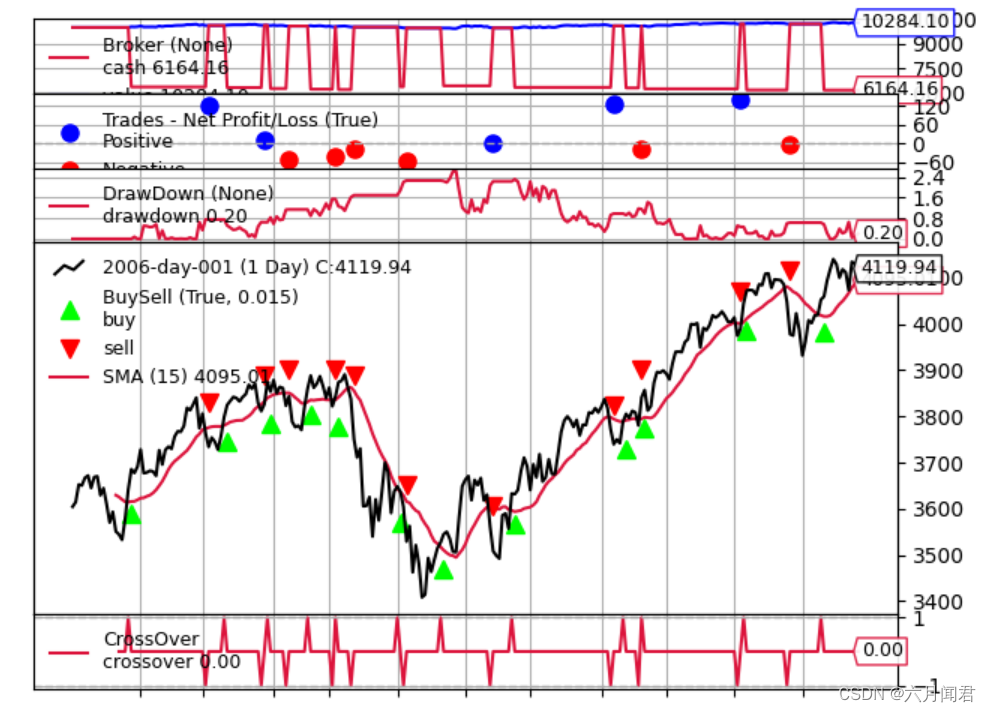

让我们采用通常的策略,当close价格超过SimpleMovingAverage时购买,如果相反则卖出。

增加一个观察者:

- DrawDown 回撤,它是backtrader 生态系统中已经存在的观察者

from __future__ import (absolute_import, division, print_function,

unicode_literals)

import argparse

import datetime

import os.path

import time

import sys

import backtrader as bt

import backtrader.feeds as btfeeds

import backtrader.indicators as btind

%matplotlib inline

class MyStrategy(bt.Strategy):

params = (('smaperiod', 15),)

def log(self, txt, dt=None):

''' Logging function fot this strategy'''

dt = dt or self.data.datetime[0]

if isinstance(dt, float):

dt = bt.num2date(dt).date()

print('%s, %s' % (dt.isoformat(), txt))

def __init__(self):

# SimpleMovingAverage on main data

# Equivalent to -> sma = btind.SMA(self.data, period=self.p.smaperiod)

sma = btind.SMA(period=self.p.smaperiod)

# CrossOver (1: up, -1: down) close / sma

self.buysell = btind.CrossOver(self.data.close, sma, plot=True)

# Sentinel to None: new ordersa allowed

self.order = None

def next(self):

# Access -1, because drawdown[0] will be calculated after "next"

self.log('DrawDown: %.2f' % self.stats.drawdown.drawdown[-1])

self.log('MaxDrawDown: %.2f' % self.stats.drawdown.maxdrawdown[-1])

# Check if we are in the market

if self.position:

if self.buysell < 0:

self.log('SELL CREATE, %.2f' % self.data.close[0])

self.sell()

elif self.buysell > 0:

self.log('BUY CREATE, %.2f' % self.data.close[0])

self.buy()

def runstrat():

cerebro = bt.Cerebro()

data = bt.feeds.BacktraderCSVData(dataname='./datas/2006-day-001.txt')

cerebro.adddata(data)

cerebro.addobserver(bt.observers.DrawDown)

cerebro.addstrategy(MyStrategy)

cerebro.run()

cerebro.plot(iplot=False)

if __name__ == '__main__':

runstrat()

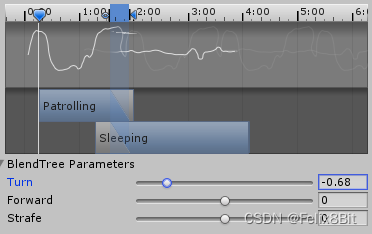

图表的输出显示了回撤的演变

输出:

... ...

2006-12-12, DrawDown: 0.63

2006-12-12, MaxDrawDown: 2.62

2006-12-13, DrawDown: 0.63

2006-12-13, MaxDrawDown: 2.62

2006-12-14, DrawDown: 0.56

2006-12-14, MaxDrawDown: 2.62

2006-12-15, DrawDown: 0.22

2006-12-15, MaxDrawDown: 2.62

2006-12-18, DrawDown: 0.00

2006-12-18, MaxDrawDown: 2.62

2006-12-19, DrawDown: 0.00

2006-12-19, MaxDrawDown: 2.62

2006-12-20, DrawDown: 0.10

2006-12-20, MaxDrawDown: 2.62

2006-12-21, DrawDown: 0.39

2006-12-21, MaxDrawDown: 2.62

2006-12-22, DrawDown: 0.21

2006-12-22, MaxDrawDown: 2.62

2006-12-27, DrawDown: 0.28

2006-12-27, MaxDrawDown: 2.62

2006-12-28, DrawDown: 0.65

2006-12-28, MaxDrawDown: 2.62

2006-12-29, DrawDown: 0.06

2006-12-29, MaxDrawDown: 2.62

注意:

如文本输出和代码中所示,DrawDown观察者实际上有2条线:

- drawdown

- maxdrawdown

选择不绘制最大回撤线,但使其可供用户使用。

实际上maxdrawdown的最后一个值也可以通过一个直接属性(而不是一条线)来获得,该属性的名称为maxdd

5.Developing Observers

上面展示了Broker观察者的实现。为了产生有意义的观察者,实现可以使用以下信息:

-

self._owner是当前正在执行的策略

策略中的任何内容都可以用于观察者 -

策略中可用的默认内部内容可能有用:

- broker-> 属性,提供对策略创建订单的broker实例的访问

如在Broker中所见,通过调用方法getcash和getvalue收集现金和组合值

- broker-> 属性,提供对策略创建订单的broker实例的访问

-

_orderspending-> 策略创建的订单列表,broker已向策略通知事件。

BuySell观察者遍历列表,查找已执行(完全或部分)的订单,以创建给定时间点(索引0)的平均执行价格 -

_tradespending-> 交易列表(已完成的买入/卖出或卖出/买入对的集合),从买入/卖出订单编译而成

观察者可以通过self._owner.stats路径访问其他观察者。

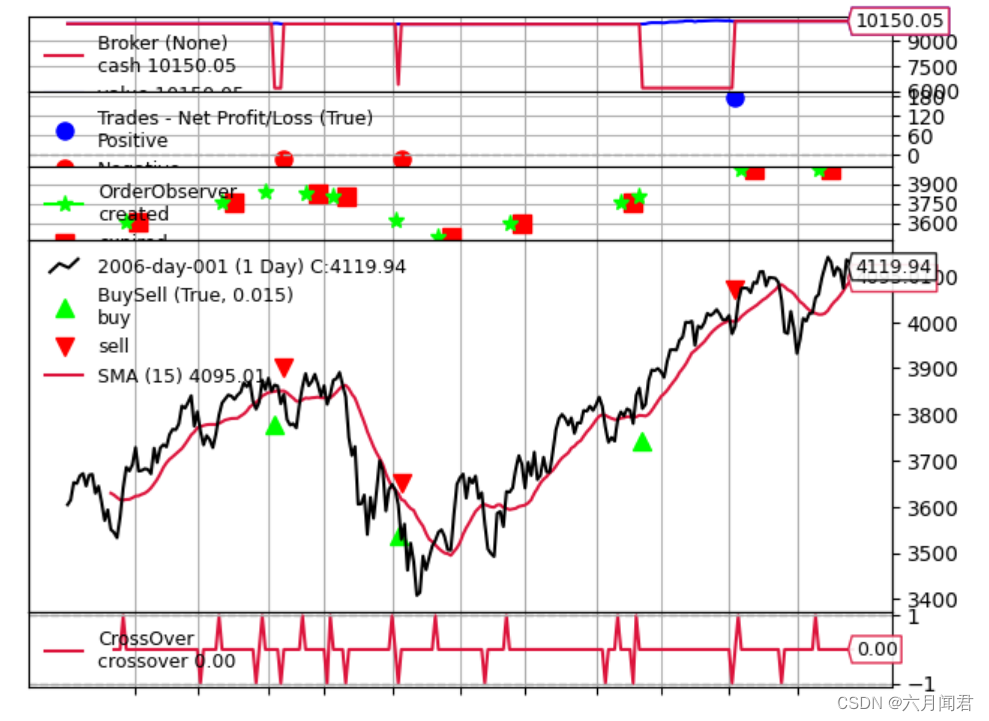

6.Custom OrderObserver

标准的BuySell观察者只关心已执行的操作。可以创建一个观察者,显示订单何时创建以及它们是否过期。

为了可见性,显示将不会沿价格轴上绘制,而是在单独的轴上绘制。

from __future__ import (absolute_import, division, print_function,

unicode_literals)

import datetime

import backtrader as bt

import backtrader.feeds as btfeeds

import backtrader.indicators as btind

#直接放在一个程序中。

#from backtrader.orderobserver import OrderObserver

%matplotlib inline

class MyStrategy(bt.Strategy):

params = (

('smaperiod', 15),

('limitperc', 1.0),

('valid', 7),

)

def log(self, txt, dt=None):

''' Logging function fot this strategy'''

dt = dt or self.data.datetime[0]

if isinstance(dt, float):

dt = bt.num2date(dt).date()

print('%s, %s' % (dt.isoformat(), txt))

def notify_order(self, order):

if order.status in [order.Submitted, order.Accepted]:

# Buy/Sell order submitted/accepted to/by broker - Nothing to do

self.log('ORDER ACCEPTED/SUBMITTED', dt=order.created.dt)

self.order = order

return

if order.status in [order.Expired]:

self.log('BUY EXPIRED')

elif order.status in [order.Completed]:

if order.isbuy():

self.log(

'BUY EXECUTED, Price: %.2f, Cost: %.2f, Comm %.2f' %

(order.executed.price,

order.executed.value,

order.executed.comm))

else: # Sell

self.log('SELL EXECUTED, Price: %.2f, Cost: %.2f, Comm %.2f' %

(order.executed.price,

order.executed.value,

order.executed.comm))

# Sentinel to None: new orders allowed

self.order = None

def __init__(self):

# SimpleMovingAverage on main data

# Equivalent to -> sma = btind.SMA(self.data, period=self.p.smaperiod)

sma = btind.SMA(period=self.p.smaperiod)

# CrossOver (1: up, -1: down) close / sma

self.buysell = btind.CrossOver(self.data.close, sma, plot=True)

# Sentinel to None: new ordersa allowed

self.order = None

def next(self):

if self.order:

# pending order ... do nothing

return

# Check if we are in the market

if self.position:

if self.buysell < 0:

self.log('SELL CREATE, %.2f' % self.data.close[0])

self.sell()

elif self.buysell > 0:

plimit = self.data.close[0] * (1.0 - self.p.limitperc / 100.0)

valid = self.data.datetime.date(0) + \

datetime.timedelta(days=self.p.valid)

self.log('BUY CREATE, %.2f' % plimit)

self.buy(exectype=bt.Order.Limit, price=plimit, valid=valid)

class OrderObserver(bt.observer.Observer):

lines = ('created', 'expired',)

plotinfo = dict(plot=True, subplot=True, plotlinelabels=True)

plotlines = dict(

created=dict(marker='*', markersize=8.0, color='lime', fillstyle='full'),

expired=dict(marker='s', markersize=8.0, color='red', fillstyle='full')

)

def next(self):

for order in self._owner._orderspending:

if order.data is not self.data:

continue

if not order.isbuy():

continue

# Only interested in "buy" orders, because the sell orders

# in the strategy are Market orders and will be immediately

# executed

if order.status in [bt.Order.Accepted, bt.Order.Submitted]:

self.lines.created[0] = order.created.price

elif order.status in [bt.Order.Expired]:

self.lines.expired[0] = order.created.price

def runstrat():

cerebro = bt.Cerebro()

data = bt.feeds.BacktraderCSVData(dataname='./datas/2006-day-001.txt')

cerebro.adddata(data)

cerebro.addobserver(OrderObserver)

cerebro.addstrategy(MyStrategy)

cerebro.run()

cerebro.plot(iplot=False)

if __name__ == '__main__':

runstrat()

自定义观察者只关心买入订单,因为这是一种只买入以试图获利的策略。卖出订单是市价订单,将立即执行。

Close-SMA CrossOver策略规则更改为:

- 创建一个价格低于此时刻收盘价1.0%以下的限价订单

- 订单的有效期为7(日历)天

如新子图(红色方块)所示,新增的Observer 对象,created 和 expired ,有几个订单已过期,还看到在创建和执行间隔了几天。

输出结果:

2006-01-26, BUY CREATE, 3605.01

2006-01-26, ORDER ACCEPTED/SUBMITTED

2006-01-26, ORDER ACCEPTED/SUBMITTED

2006-02-02, BUY EXPIRED

2006-03-10, BUY CREATE, 3760.48

2006-03-10, ORDER ACCEPTED/SUBMITTED

2006-03-10, ORDER ACCEPTED/SUBMITTED

2006-03-17, BUY EXPIRED

2006-03-30, BUY CREATE, 3835.86

2006-03-30, ORDER ACCEPTED/SUBMITTED

2006-03-30, ORDER ACCEPTED/SUBMITTED

2006-04-05, BUY EXECUTED, Price: 3835.86, Cost: 3835.86, Comm 0.00

2006-04-07, SELL CREATE, 3823.11

2006-04-07, ORDER ACCEPTED/SUBMITTED

2006-04-07, ORDER ACCEPTED/SUBMITTED

2006-04-10, SELL EXECUTED, Price: 3822.35, Cost: 3835.86, Comm 0.00

2006-04-20, BUY CREATE, 3821.40

2006-04-20, ORDER ACCEPTED/SUBMITTED

2006-04-20, ORDER ACCEPTED/SUBMITTED

2006-04-27, BUY EXPIRED

2006-05-04, BUY CREATE, 3804.65

2006-05-04, ORDER ACCEPTED/SUBMITTED

2006-05-04, ORDER ACCEPTED/SUBMITTED

2006-05-11, BUY EXPIRED

2006-06-01, BUY CREATE, 3611.85

2006-06-01, ORDER ACCEPTED/SUBMITTED

2006-06-01, ORDER ACCEPTED/SUBMITTED

2006-06-05, BUY EXECUTED, Price: 3611.85, Cost: 3611.85, Comm 0.00

2006-06-05, SELL CREATE, 3604.33

2006-06-05, ORDER ACCEPTED/SUBMITTED

2006-06-05, ORDER ACCEPTED/SUBMITTED

2006-06-06, SELL EXECUTED, Price: 3598.58, Cost: 3611.85, Comm 0.00

2006-06-21, BUY CREATE, 3491.57

2006-06-21, ORDER ACCEPTED/SUBMITTED

2006-06-21, ORDER ACCEPTED/SUBMITTED

2006-06-28, BUY EXPIRED

2006-07-24, BUY CREATE, 3596.60

2006-07-24, ORDER ACCEPTED/SUBMITTED

2006-07-24, ORDER ACCEPTED/SUBMITTED

2006-07-31, BUY EXPIRED

2006-09-12, BUY CREATE, 3751.07

2006-09-12, ORDER ACCEPTED/SUBMITTED

2006-09-12, ORDER ACCEPTED/SUBMITTED

2006-09-19, BUY EXPIRED

2006-09-20, BUY CREATE, 3802.90

2006-09-20, ORDER ACCEPTED/SUBMITTED

2006-09-20, ORDER ACCEPTED/SUBMITTED

2006-09-22, BUY EXECUTED, Price: 3802.90, Cost: 3802.90, Comm 0.00

2006-11-02, SELL CREATE, 3974.62

2006-11-02, ORDER ACCEPTED/SUBMITTED

2006-11-02, ORDER ACCEPTED/SUBMITTED

2006-11-03, SELL EXECUTED, Price: 3979.73, Cost: 3802.90, Comm 0.00

2006-11-06, BUY CREATE, 4004.77

2006-11-06, ORDER ACCEPTED/SUBMITTED

2006-11-06, ORDER ACCEPTED/SUBMITTED

2006-11-13, BUY EXPIRED

2006-12-11, BUY CREATE, 4012.36

2006-12-11, ORDER ACCEPTED/SUBMITTED

2006-12-11, ORDER ACCEPTED/SUBMITTED

2006-12-18, BUY EXPIRED

最后,应用新的观察者的策略代码,见前。

7.Saving/Keeping the statistics

保存/保持统计信息到目前为止,backtrader尚未实现任何机制来跟踪观察者的值并将其存储到文件中。最好的方法是:

- 在策略的start方法中打开文件

- 在策略的next方法中将值写入

考虑到DrawDown观察者,可以做:

class MyStrategy(bt.Strategy):

def start(self):

self.mystats = open('mystats.csv', 'wb')

self.mystats.write('datetime,drawdown, maxdrawdown\n')

def next(self):

self.mystats.write(self.data.datetime.date(0).strftime('%Y-%m-%d'))

self.mystats.write(',%.2f' % self.stats.drawdown.drawdown[-1])

self.mystats.write(',%.2f' % self.stats.drawdown.maxdrawdown-1])

self.mystats.write('\n')

要保存索引0的值,一旦处理完所有观察者,可以将自定义观察者添加为系统中的最后一个观察者,以将值保存到csv文件中。

注意:Writer的功能可以自动化此任务。